Hello readers, today we are going to talk about a “new-age” startup business that has rocked the stock market with its astronomical surge in stock price (well, it’s Zomato). To give you some context, Zomato’s share price has risen 4X since July 2023. Now the question arises whether it is a viable investment option, especially since it is trading at a Price-to-Earnings ratio of a whopping 395! (I will get back to this absurdly huge number.) Let’s dive deep into Zomato and uncover its future prospects.

About the company: For those of you who don’t know, Zomato is an India-based technology business focused on various sectors such as food delivery, quick commerce (delivery of groceries within 10 minutes in top urban cities of India), restaurant supply (B2B vertical), outdoor dining, and many more. It has a monthly active user base of 80 million. It was founded by Deepinder Goyal and Pankaj Chaddah in 2008. Since then, it has attracted huge investments from funds such as Tiger Global. Let us have a look at the financials of Zomato

Financials-

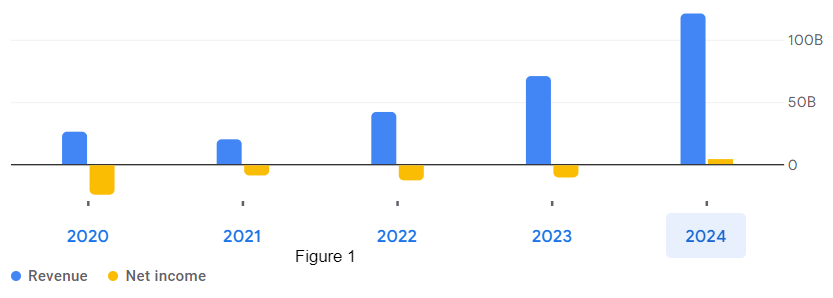

Fig 1-

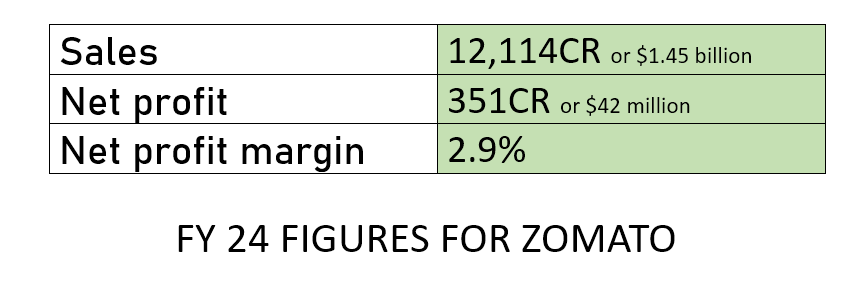

Fig 2 -

Fig 1 describes the past financial performance of Zomato, and Fig 2 shows the FY 24 figures for Zomato. As many of you might have noticed, the valuation is a bit absurd (if not very!). To put this in perspective, Zomato generated $42 million in profits by the end of FY 24 and is currently trading at a behemoth valuation of $28 billion! That too for a company that has lost money in 2020, 2021, 2022, and 2023! In its first year of profitability, it posted a net profit margin of 2.9%. Yes, it has a trailing TTM net profit (earnings of the past twelve months) of $84 million, but that is nowhere near the valuation of $28 billion.

That being said, the counter-argument is that it is a new-age business in a growing market, and hence investors are valuing it for its future potential. There are many reasons for this possible overvaluation:

Optimistic state of affairs: The Indian equity markets have been in an optimistic mood, and that has driven the price of stocks. More and more inflows from retail and foreign investors are helping fuel the craze further.

Startup profitability causing investor inflow: There is initially a huge rush of investors when companies like Zomato, after years of burning investors’ money, turn profitable (cherry on the cake, it is the market leader). This excites investors, especially venture capitalists and private equity firms, who want a piece of the “next big thing” in the startup world.

Growing market: Most of the categories/sectors in which zomato does business are regarded as a growing market. For example quick commerce is expected to grow at a CAGR of 20-25% for the next 5 years.

An overly optimistic way of predicting cashflows-

A dollar earned by Zomato is being valued at $395. To put this in perspective, let’s say you want to buy a local grocery shop for investment purposes. The grocery store posts a profit of $100,000 every year. How many times its earnings would you pay for it?

10 times? $1 million

20 times? $2 million

Definitely not 395 times, which is - $39.5 million.

Let us now get into predicting Zomato’s future valuation. Zomato currently has a net profit of $0.042 billion($42 million). Let us be optimistic and assume that from henceforth, Zomato will double its net profit every year (an overly optimistic assumption). After doing the math, we arrive at the answer that even if Zomato doubles its profit every year, it would take 9.38 years to just reach this valuation ($28 billion). To put this in perspective, Zomato would have to double its profit every year continuously for 9 years, which is pretty unlikely.

Poor capital allocation-

For those who don’t know ROCE(Return on capital employed) is calculated by dividing the net operating profit by the total cpital employed(which includes both liability and equity) multiplied by 100. Basically the more the operating profit you produce on less the capital, more is the ROCE. The problem is Zomato’s ROCE is very less. For every $100 employed as capital , only $1.14 of return/profit is produced(which is a return of 1.14%). This may indicate poor capital allocation.This metric(ROCE) is expected to increase as zomato becomes more and more profitable.

Competitors with cheaper valuations -

Swiggy , one of Zomato’s main competitors has almost half the valuation of Zomato(around $13 billion) , though there is a difference of only $100 million in FY24 revenues between the two giants.There are some advantages to Zomato as well for example Zomato is profitable while swiggy is not profitable at all(It posted a loss of around 2000 crores in FY 24). But the delta in valuation may prompt investors to change their mind.

Early investors exiting -

Many early venture capital funds that invested in Zomato have or are planning to exit. Some of them are listed below:

Softbank Venture Capital Fund exited Zomato in December 2023, selling around a 1% stake for Rs. 1127.5 Crores.

Antfin Group sold shares worth $575 million (Rs. 4600 Crores) in November 2023.

Tiger Global divested its stake for around Rs. 1000 Crores.

Total divestments by early investors amount to Rs. 6700 Crores.

This might be a possible red flag.

All this being said, there is a way for Zomato to reach its valuation. Though unlikely, a one-time surge of 10X or 20X in net profits can set things straight for Zomato.

Although at the time of writing this , entering this stock does seem extremely risky.

Sources-

Google finance - for figure 1 graphs

Zomato annual report- all financials

Moneycontrol.com- news on early investor exits