Hello reader’s , In today’s edition we are going to explore an Indian chemical company called PI industries which is a key player in the agricultural products market. At first glance this might seem like an expensive buy (with a PE of 35) , but is it a reasonable price to pay for the growth this firm may offer ? To answer this question we will need to see how the company generates earnings , how it plans to increase its earnings , will it foray into new markets ? etc. For this we should have a clear understanding of what the company is .

Market Cap ₹ 55,439 Cr.

Current Price ₹ 3,654

High / Low ₹ 4,040 / 3,060

Stock P/E 34.8

About the company - PI Industries Ltd is a leading player in the Agro-chemicals space having strong presence in both Domestic and Export markets. It has state-of-art facilities in Gujarat having integrated process development teams with in-house engineering capabilities. It also aims to promote research and development in India by investing 3-4% of its revenue in research . This is also one of it’s main competitive advantage , the ability to innovate on its own without depending on others for the technology . We will dig deep into this point later . The company is also involved in the Agro - chemical CSM (custom synthesis manufacturing) business , which brings in a whopping 75 % of its revenue (FY 23) .The company is also aiming to grow in a responsible way and it explains how it plans to do so in its annual report . To understand more let us dive deep into the financials .

Consolidated Balance sheet (FY 23) -

The above table provides a picture of balance sheet . Its total assets amount to around 8480 crores (USD 1 billion) and its total liabilities is at 1200 crores . This assures that the company is not going to go bankrupt anytime soon . Even if we don’t count the intangible assets ( Intangible assets are assets which are not physical in nature . For a company like Coca - Cola its “brand” which is admired by many , is an asset for the company . Intangible assets also include patents and other intellectual properties . We are not taking this into consideration since it is very difficult to value these assets and what the balance sheet says may not always be true ) the company is well - off . The balance sheet is reassuring and there is no anomalies as such . In short PI industries has a strong balance sheet .

Income statement -

Revenue from operations has increased 23% Year - on -Year and at the same time expenditure has risen 21 % . Profit after tax is 1230 crores up by 46 % from last year.

The firm has a strong earnings growth and will most likely extend it into the future .

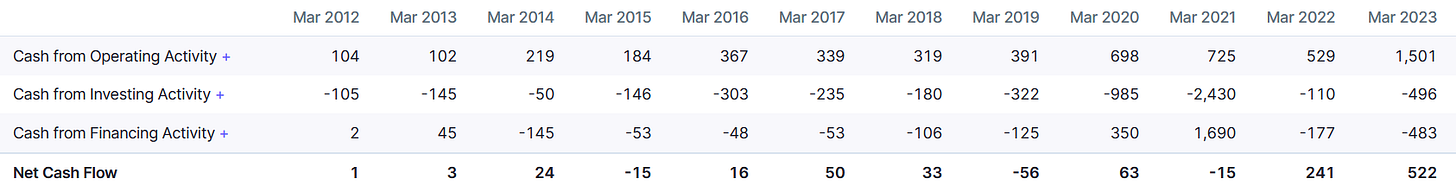

Cashflow statements -

The firm has improved its cashflow position constantly . It is has a positive cashflow value . The cashflow statements also reassert the confidence in the company . In all the company has a strong balance sheet , earnings and cashflow . Now the question arises what are you paying for these ? How to justify the valuation ? It has a huge PE multiple of 35 . So as to justify the valuation I have the following points -

High earnings growth -

While it has a huge PE it also has considerable earnings growth . Veteran investor Peter Lynch talks about a particular PEG ratio . PEG ratio is a firm’s PE divided by its earnings growth over a period of time . In this metric Lynch considers firm’s with a PEG ratio less than 1 to be undervalued . In this case PI industries has an PEG ratio of 0.89 .

Research and development -

It is rather unusual to see an Indian company invest this much in R & D , since it requires huge investment and it takes many years to pay off . Above all it is rather difficult to innovate . But when you look at the value chain , most value is created at the ends of the chain which is - R&D being the first and Branding , sales and marketing the end . Least value is created in manufacturing . While R&D in the Agro-chemical business is dominated by multi - national companies such as BASF , Syngenta , Bayer etc , PI industries is aiming to innovate on its own . This if implemented correctly can create value for the shareholders . The company has installed a new state of the art facility in Udaipur .

Trust -

The company’s main business which is custom synthesis manufacturing (the exclusive synthesis of compounds on behalf of the customer, i.e., you can order a specific molecule that is only synthesized on your request on the scale, with the purity and with the specification or methods you require.)involves it to deal with the intellectual properties of many companies . This requires considerable trust , given it can affect the company in question with long courtroom sessions . PI industries is apparently trusted by its customers , which involve companies like BASF , Bayer , Mitsui etc.

It will be difficult for a new entrant in the market to create trust . The company also plans to venture into the Pharma - CSM market which is a bigger market (According to Forbes India).This may potentially drive earnings growth in the future .

Conclusion -

PI industries currently is in a good position . Its financial statements reassure us of that . This company has potential to be a multi-bagger .

(Disclaimer : I am not registered with authorities such as SEBI or IRDAI . Therefore all the content provided through this blog is purely for educational purposes only. This blog will mostly cover stories of Indian firms , but will also cover international stories occasionally.)